Upon the closing of the deal, shareholders of Dril-Quip will hold around 52% ownership, while Innovex Downhole Solutions’ shareholders will own approximately 48% of the combined company, considering fully diluted shares

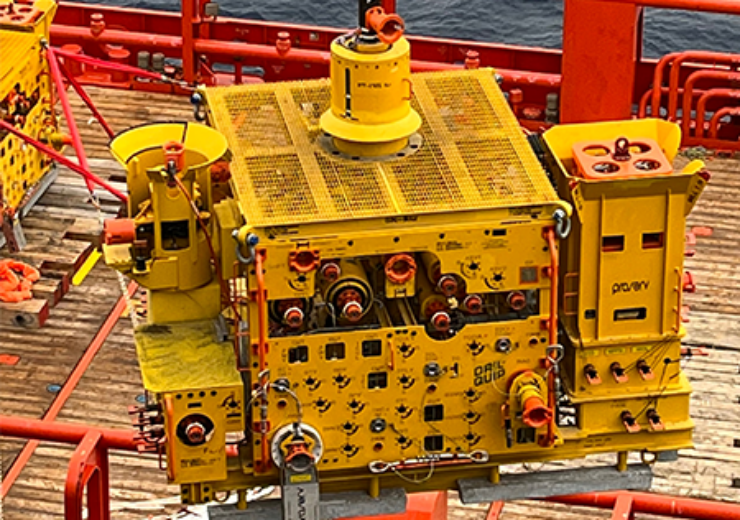

Dril-Quip signs all-stock merger deal with Innovex Downhole Solutions. (Credit: Dril-Quip, Inc.)

American oilfield service companies Dril-Quip and Innovex Downhole Solutions have agreed to merge in an all-stock deal with an aim to establish a unique energy industrial platform having more than $1bn in annual revenue.

Based in Texas, Innovex Downhole Solutions caters to upstream activities across onshore and offshore locations worldwide.

The company focuses on designing, manufacturing, and implementing vital solutions for drilling, deployment, well construction, completion, production, as well as fishing and intervention operations.

Dril-Quip specialises in the development, manufacturing, and provision of advanced equipment and services tailored for both offshore and onshore sectors of the global oil and gas industry. The firm is listed on the New York Stock Exchange (NYSE).

Following the completion of the transaction, Dril-Quip’s shareholders will hold around 52% ownership, while Innovex Downhole Solutions’ shareholders will own approximately 48% of the combined company, considering fully diluted shares.

The merger unites the complementary and curated product portfolios of both companies, alongside their top-tier safety standards, service quality, global infrastructures, and customer relationships.

It is anticipated that approximately 56% of the combined company’s revenue will come from international and offshore markets, with the remaining 44% derived from the onshore markets in the US and Canada.

Dril-Quip president and CEO Jeffrey Bird said: “This transaction is aligned with the growth strategy we have been pursuing and will advance our position as a leading developer and provider of highly engineered and innovative equipment, services and technologies for the global oil and gas industry.

“The multi-decade legacy and strong reputation of Dril-Quip’s technology, brand and expertise, paired with the customer-centric, innovative and execution-oriented cultures of both companies will help us continue to manufacture and deliver innovative products and service to our customers and create opportunities for our employees.”

Innovex Downhole Solutions is majority owned by funds associated with specialised private equity firm Amberjack Capital Partners. At closing, the private equity firm will own around 43% of the combined entity.

Innovex CEO Adam Anderson said: “We are bringing together the great traditions and capabilities of Dril-Quip with Innovex’s proven operating model. By empowering the combined organisation using Innovex’s collaborative ‘No Barriers’ culture, we will unleash the capabilities of the combined company to create a unique energy industrial platform with durable margins, low capital intensity and the potential for superior returns on capital throughout industry cycles.”

Anderson will take over as the CEO of the combined firm.

Upon the conclusion of the transaction, the combined company will undergo a name change to Innovex International with its common stock anticipated to be traded on the NYSE. The headquarters of the combined entity will be situated in Houston, Texas.

The transaction has received approval from the boards of directors of both companies and is anticipated to conclude in Q3 2024. The closing is contingent upon customary conditions, including regulatory approval and approval by Dril-Quip’s shareholders.

Citi is acting as the lead financial adviser, with Morgan Stanley & Co. as co-financial adviser to Dril-Quip. Legal counsel for Dril-Quip is provided by Gibson, Dunn & Crutcher.

On the other hand, Goldman Sachs & Co. is serving as the lead financial adviser, alongside Piper Sandler as co-financial adviser to Innovex Downhole Solutions. Legal representation for Innovex Downhole Solutions is provided by Akin Gump Strauss Hauer & Feld, with assistance from Paul Hastings.